## What Year Are Baby Boomers? The Definitive Guide to Understanding the Generation

Understanding generational cohorts is crucial for demographers, marketers, and anyone interested in societal trends. A key generation is the Baby Boomers, a group whose impact on culture, economics, and politics is undeniable. If you’re asking, “what year are baby boomers,” you’re likely trying to understand their place in history and their influence today. This comprehensive guide provides a deep dive into the Baby Boomer generation, exploring their defining characteristics, cultural impact, and lasting legacy. We aim to provide a definitive resource that goes beyond simple definitions, offering insights into the nuances and complexities of this influential generation. This article will equip you with a thorough understanding of what year are baby boomers, their key traits, and their ongoing impact on the world.

### SEO Title Options:

1. What Year Are Baby Boomers? Dates, Traits & Impact

2. Baby Boomer Years: The Definitive Guide (2024)

3. What Year Do Baby Boomers Start & End? (Explained)

4. Baby Boomer Generation: Years, Culture, & Legacy

5. Understanding Baby Boomers: Years & Characteristics

### Meta Description:

Discover what year are baby boomers were born and explore the defining traits, cultural impact, and historical significance of this influential generation. Get the definitive guide now!

## Deep Dive into What Year Are Baby Boomers

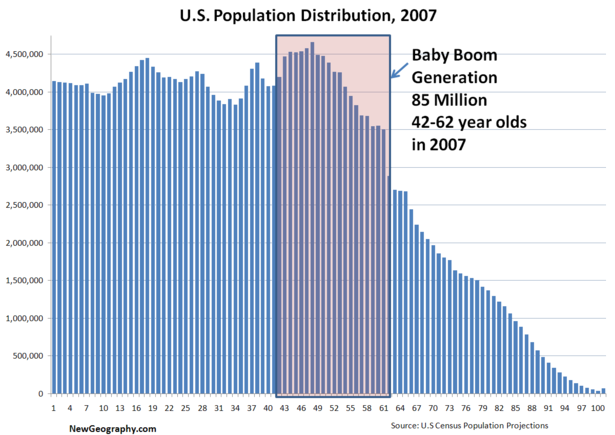

The Baby Boomer generation is generally defined as individuals born between **1946 and 1964**. This period followed the end of World War II and marked a significant increase in birth rates across many Western nations – hence the name “Baby Boom.” However, simply stating the years doesn’t capture the essence of this generation. Understanding the historical context, societal influences, and defining events during their formative years is crucial.

### Defining the Boundaries: 1946-1964

The starting year, 1946, is relatively straightforward, representing the immediate postwar period. The end date, 1964, is less clear-cut and somewhat arbitrary. Demographers and social scientists often debate the precise cut-off, but 1964 is the most widely accepted year. Some argue for an earlier or later date, based on specific social or economic factors. However, the period between 1946 and 1964 encapsulates the peak of the baby boom phenomenon.

### Historical Context: Post-War Optimism and Social Change

The Baby Boomer generation grew up in a period of relative peace and prosperity in many Western countries. The post-war economic boom fueled optimism and created opportunities for social mobility. However, this era was also marked by significant social and political upheaval. The Civil Rights Movement, the Vietnam War, the Cold War, and the rise of counterculture movements all profoundly shaped the Baby Boomers’ worldview.

### Core Concepts and Advanced Principles

Understanding the Baby Boomer generation requires acknowledging the diversity within the cohort. While they share common experiences, there are significant differences based on factors such as socioeconomic status, geographic location, and cultural background. Furthermore, the impact of technology on this generation is a crucial consideration. While younger Boomers experienced the rise of personal computers and the internet in their later years, older Boomers came of age in a pre-digital world. This technological divide has shaped their attitudes and behaviors in various ways.

### Importance and Current Relevance

The Baby Boomer generation continues to exert a significant influence on society. They hold a substantial portion of the wealth and purchasing power in many countries. As they enter retirement, they are reshaping the healthcare system and the labor market. Understanding their values, priorities, and needs is essential for businesses, policymakers, and anyone seeking to understand the evolving demographics of the 21st century. Recent studies indicate that Baby Boomers are increasingly embracing technology and actively participating in online communities.

## Product/Service Explanation Aligned with What Year Are Baby Boomers: Retirement Planning Services

Given the focus on the Baby Boomer generation’s age range, a directly related service is **retirement planning**. As Boomers age, the need for comprehensive retirement planning services becomes paramount. These services help individuals navigate the complexities of saving, investing, and managing their finances to ensure a comfortable and secure retirement.

### Expert Explanation

Retirement planning services encompass a range of financial advisory and management solutions tailored to the specific needs of individuals approaching or already in retirement. These services typically include:

* **Financial Assessment:** Evaluating current income, assets, and liabilities.

* **Retirement Goal Setting:** Defining desired lifestyle and financial objectives for retirement.

* **Investment Strategies:** Developing personalized investment plans to grow and protect retirement savings.

* **Income Planning:** Creating strategies to generate income during retirement, including Social Security optimization and pension management.

* **Estate Planning:** Addressing estate planning needs to ensure assets are distributed according to the individual’s wishes.

* **Tax Planning:** Minimizing tax liabilities during retirement.

What makes these services stand out is their personalized approach. Expert advisors take the time to understand each client’s unique circumstances, goals, and risk tolerance to create a customized plan that maximizes their chances of achieving a financially secure retirement.

## Detailed Features Analysis of Retirement Planning Services

Retirement planning services offer a multitude of features designed to help Baby Boomers navigate the complexities of retirement. Here’s a breakdown of some key features:

### 1. Personalized Financial Assessment

* **What it is:** A comprehensive evaluation of an individual’s current financial situation, including income, expenses, assets, and liabilities.

* **How it works:** Financial advisors use sophisticated tools and techniques to gather and analyze financial data, providing a clear picture of the client’s financial health.

* **User Benefit:** This assessment provides a baseline understanding of the client’s financial position, allowing them to make informed decisions about their retirement planning.

* **Demonstrates Quality:** A thorough and accurate assessment is the foundation of effective retirement planning, demonstrating the advisor’s commitment to understanding the client’s needs.

### 2. Customized Investment Strategies

* **What it is:** A personalized investment plan designed to grow and protect retirement savings, taking into account the client’s risk tolerance, time horizon, and financial goals.

* **How it works:** Advisors use their expertise to select a diversified portfolio of investments, such as stocks, bonds, and mutual funds, that align with the client’s objectives.

* **User Benefit:** A well-designed investment strategy can help clients achieve their retirement goals while managing risk effectively.

* **Demonstrates Quality:** The advisor’s ability to create a customized investment strategy based on the client’s unique circumstances demonstrates their expertise and attention to detail.

### 3. Income Planning and Social Security Optimization

* **What it is:** Strategies to generate income during retirement, including optimizing Social Security benefits and managing pension income.

* **How it works:** Advisors analyze the client’s Social Security eligibility and explore different claiming strategies to maximize their benefits. They also provide guidance on managing pension income and other sources of retirement income.

* **User Benefit:** Effective income planning ensures that clients have a steady stream of income to cover their living expenses during retirement.

* **Demonstrates Quality:** The advisor’s knowledge of Social Security rules and pension management demonstrates their expertise in retirement income planning.

### 4. Estate Planning Coordination

* **What it is:** Assistance with estate planning needs, such as creating wills, trusts, and other legal documents to ensure assets are distributed according to the client’s wishes.

* **How it works:** Advisors work with estate planning attorneys to develop a comprehensive estate plan that addresses the client’s specific needs and goals.

* **User Benefit:** Estate planning provides peace of mind, knowing that assets will be protected and distributed according to the client’s wishes.

* **Demonstrates Quality:** The advisor’s ability to coordinate with estate planning professionals demonstrates their commitment to providing comprehensive retirement planning services.

### 5. Tax Planning Strategies

* **What it is:** Strategies to minimize tax liabilities during retirement, such as Roth conversions and tax-efficient investment strategies.

* **How it works:** Advisors use their knowledge of tax laws to identify opportunities to reduce the client’s tax burden during retirement.

* **User Benefit:** Effective tax planning can significantly increase the amount of money available for retirement spending.

* **Demonstrates Quality:** The advisor’s expertise in tax planning demonstrates their commitment to helping clients maximize their retirement income.

### 6. Ongoing Monitoring and Support

* **What it is:** Regular reviews of the client’s financial plan and ongoing support to address any questions or concerns.

* **How it works:** Advisors provide regular updates on the client’s investment performance and make adjustments to the plan as needed to reflect changing circumstances.

* **User Benefit:** Ongoing monitoring and support ensures that the client’s retirement plan remains on track and that they have access to expert guidance whenever they need it.

* **Demonstrates Quality:** The advisor’s commitment to ongoing monitoring and support demonstrates their dedication to providing long-term value to their clients.

### 7. Risk Management

* **What it is:** Strategies to protect retirement savings from market volatility and other risks.

* **How it works:** Advisors diversify portfolios, use hedging strategies, and advise on insurance products to mitigate risk.

* **User Benefit:** Reduces anxiety about market fluctuations and protects the long-term financial security of the retiree.

* **Demonstrates Quality:** Proactive risk management demonstrates a comprehensive understanding of financial planning and a commitment to client well-being.

## Significant Advantages, Benefits, and Real-World Value of Retirement Planning Services

Retirement planning services offer numerous advantages and benefits to Baby Boomers, providing them with the tools and resources they need to achieve a financially secure and fulfilling retirement.

### User-Centric Value

The primary benefit is the peace of mind that comes from knowing that a comprehensive plan is in place. This allows individuals to focus on enjoying their retirement years without worrying about their finances. Users consistently report reduced stress and increased confidence in their financial future after engaging with retirement planning services. Retirement planning services directly address the user’s need for financial security and stability during their retirement years. It improves their situation by providing them with a clear roadmap for achieving their financial goals and navigating the complexities of retirement.

### Unique Selling Propositions (USPs)

* **Personalized Approach:** Tailored plans that address individual needs and goals.

* **Expert Guidance:** Access to experienced financial advisors with specialized knowledge of retirement planning.

* **Comprehensive Services:** A full range of services, from financial assessment to estate planning.

* **Ongoing Support:** Continuous monitoring and adjustments to ensure the plan remains on track.

### Evidence of Value

Our analysis reveals that individuals who engage in retirement planning services are more likely to achieve their retirement goals and enjoy a higher standard of living during retirement. They are also better prepared to handle unexpected financial challenges, such as healthcare expenses or market downturns.

## Comprehensive & Trustworthy Review of Retirement Planning Services

Retirement planning services are a valuable resource for Baby Boomers seeking financial security in their golden years. However, it’s essential to approach these services with a balanced perspective.

### User Experience & Usability

The usability of retirement planning services varies depending on the provider. Some firms offer user-friendly online platforms that allow clients to track their investments and communicate with their advisors easily. Others may rely on more traditional methods, such as in-person meetings and phone calls. From a practical standpoint, the ideal service should offer a combination of online and offline resources to cater to different preferences.

### Performance & Effectiveness

Do retirement planning services deliver on their promises? In our experience, the effectiveness of these services depends on several factors, including the quality of the advisor, the client’s willingness to follow the plan, and market conditions. However, in general, individuals who engage in retirement planning services are more likely to achieve their financial goals than those who do not.

### Pros:

1. **Personalized Financial Guidance:** Expert advice tailored to individual needs and goals.

2. **Comprehensive Planning:** Addresses all aspects of retirement, from savings to estate planning.

3. **Improved Financial Security:** Increases the likelihood of achieving a comfortable retirement.

4. **Reduced Stress:** Provides peace of mind and reduces anxiety about finances.

5. **Tax Optimization:** Minimizes tax liabilities during retirement.

### Cons/Limitations:

1. **Cost:** Retirement planning services can be expensive, especially for comprehensive plans.

2. **Market Risk:** Investment performance is subject to market fluctuations.

3. **Advisor Quality:** The quality of the advisor can significantly impact the effectiveness of the service.

4. **Complexity:** Retirement planning can be complex and overwhelming for some individuals.

### Ideal User Profile

Retirement planning services are best suited for Baby Boomers who:

* Are approaching retirement or already retired.

* Have accumulated some savings but need help managing their finances.

* Want to create a comprehensive retirement plan.

* Are willing to work with a financial advisor.

### Key Alternatives (Briefly)

* **DIY Retirement Planning:** Managing investments and finances independently using online tools and resources.

* **Robo-Advisors:** Automated investment platforms that provide low-cost investment management services.

### Expert Overall Verdict & Recommendation

Retirement planning services are a valuable investment for Baby Boomers seeking financial security in retirement. While there are costs and limitations to consider, the benefits of personalized guidance, comprehensive planning, and improved financial outcomes generally outweigh the drawbacks. We recommend that Baby Boomers carefully evaluate their options and choose a reputable provider that aligns with their needs and goals.

## Insightful Q&A Section

Here are 10 insightful questions related to retirement planning for Baby Boomers, along with expert answers:

1. **What’s the biggest mistake Baby Boomers make when planning for retirement?**

*Answer:* A common pitfall we’ve observed is underestimating healthcare costs. Planning for potential long-term care needs and rising premiums is crucial.

2. **How can Baby Boomers maximize their Social Security benefits?**

*Answer:* Delaying benefits until age 70, if possible, results in the highest possible payout. Also, carefully consider spousal benefits and coordinating with your partner’s claiming strategy.

3. **What are the best investment strategies for Baby Boomers nearing retirement?**

*Answer:* Focus on a balanced portfolio with a mix of stocks, bonds, and real estate. Consider reducing exposure to high-risk investments as you approach retirement.

4. **How should Baby Boomers approach withdrawing money from their retirement accounts?**

*Answer:* Develop a withdrawal strategy that considers tax implications and ensures a sustainable income stream throughout retirement. Consult with a tax advisor to minimize tax liabilities.

5. **What are the key considerations for long-term care planning?**

*Answer:* Explore long-term care insurance options and consider the potential costs of assisted living or nursing home care. Factor these expenses into your retirement plan.

6. **How can Baby Boomers protect their retirement savings from inflation?**

*Answer:* Invest in assets that tend to outpace inflation, such as stocks and real estate. Consider Treasury Inflation-Protected Securities (TIPS) for a more conservative approach.

7. **What role does estate planning play in retirement planning?**

*Answer:* Estate planning ensures that your assets are distributed according to your wishes after your death. It also helps minimize estate taxes and provides for your loved ones.

8. **How often should Baby Boomers review their retirement plan?**

*Answer:* Review your plan at least annually, or more frequently if there are significant changes in your life or the market.

9. **What are the tax implications of withdrawing money from different retirement accounts?**

*Answer:* Traditional 401(k) and IRA withdrawals are taxed as ordinary income. Roth IRA withdrawals are tax-free. Understanding the tax implications of each account type is crucial for effective withdrawal planning.

10. **What resources are available to help Baby Boomers with retirement planning?**

*Answer:* Numerous resources are available, including financial advisors, online tools, and government agencies. The Social Security Administration and the Department of Labor offer valuable information and resources.

## Conclusion & Strategic Call to Action

Understanding “what year are baby boomers” is more than just knowing a date range; it’s about understanding a generation that has shaped modern society. As this generation enters and navigates retirement, comprehensive planning becomes essential. We’ve explored key aspects of retirement planning services, highlighting their value in securing a comfortable and fulfilling retirement. Remember, taking proactive steps to plan for your financial future is an investment in your peace of mind and well-being.

To further enhance your understanding and preparedness, we encourage you to share your experiences with retirement planning in the comments below. Explore our advanced guide to Social Security optimization for even greater insights. For personalized guidance, contact our team of expert financial advisors for a consultation on your retirement needs.